If you are entering any of the funded futures trader evaluations, there will be rules related to Trailing Draw Downs and Daily Loss Limits. They can often confuse new traders, so below I explain each of them, how to monitor them, and best strategies to not hit your trailing draw down or daily loss limit.

I will mention up front that understanding the concepts is the first part. The second part is for you to make sure you are clear on how your chose funded futures trader evaluation company calculates them. Is it during each trade? After each trade? At the end of the day? This can make a big difference in possibly breaking a rule.

Be sure to read my Reviews of Funded Futures Trader Evaluations if you are considering joining one of the programs. I keep it updated daily!

The Difference – 2 Different Types Of Maximum Loss

The first thing I want to make sure people are clear on is Daily Loss Limit and Trailing Draw Down (also called a Trailing Stop Loss) are 2 different ways of setting a maximum amount you can lose before you violate a rule. It’s important to understand how they both work, and what your limits are before you start your trading day.

Daily Loss Limit Explained

Daily Loss Limit is the easier of the 2 for people to comprehend. It is a dollar amount that is fixed, and it is exactly as the name implies. It is your daily loss limit, you can’t lose more than this amount, or you break a rule.

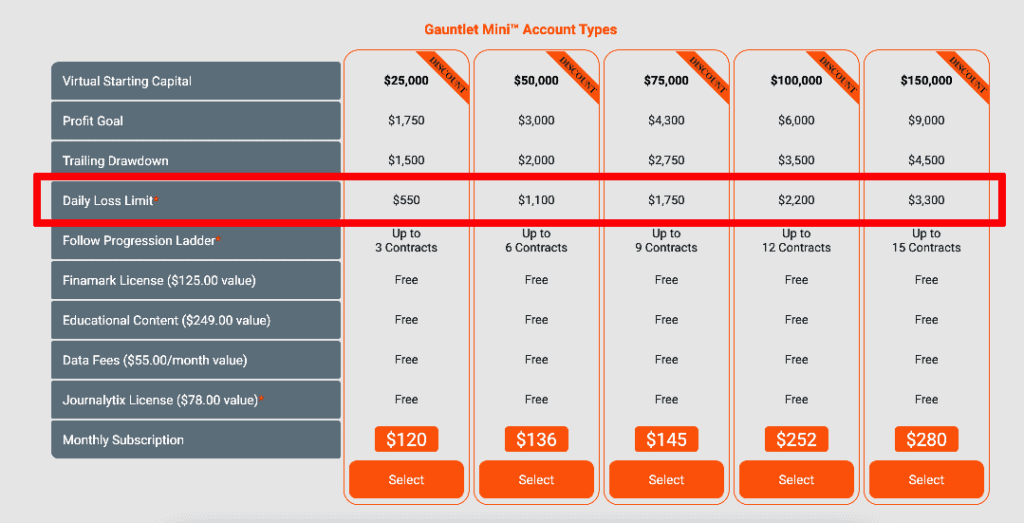

Looking at the example below from Earn2Trade, the most you could lose for each account size in 1 day is listed as the Daily Loss Limit. For example, the $100,000 Gauntlet Mini maximum daily loss is $2,200.

As far as I know, all of the evaluation companies keep track of this real time. This is important because you may lose $2,201 and the bounce back to end the day only down $1,800. The problem is you violated the rule. You can’t break the Daily Loss Limit rule at any point intraday.

Trailing Draw Down Explained

Trailing draw down is the tougher one for people to wrap their heads around for a few reasons. First, sometimes it moves, but sometimes it doesn’t. Second, each company treats how it moves differently.

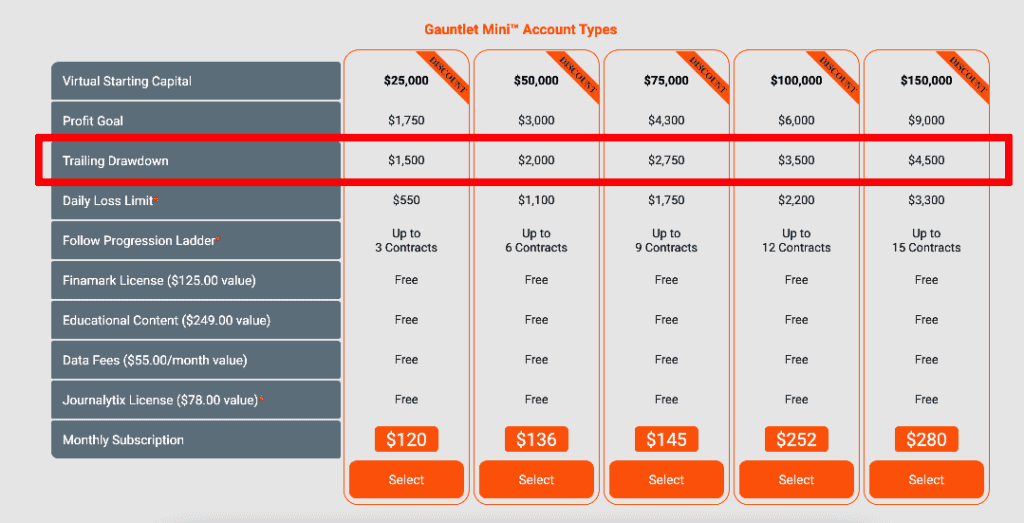

First step – know what the trailing draw down amount will be to start. In the example below from Earn2Trade, the $100,00 Gauntlet Mini has a $3,500 trailing drawdown.

Second step – Understand how it moves. Always remember above all it only moves up, never down. This is where things can start to get a little confusing though. When it moves up varies. Some companies only look at this at the end of the day. Others after each trade. Others, during the trade. Knowing this is very important.

An example comparing 2 different methods. Assume a $100,000 account with a $3,500 trailing drawdown. You do 2 trades on day 1. Trade #1 you make $2,500. Trade #2 you lose $1,000. Your ending balance is $101,500 ($100,000 + $2,500 – $1,000).

For a company who updates only at end of day, they don’t care about the individual trades. Your account balance is $101, 500 at the end of the day and your trailing draw down has been pulled up by $1,500. Your balance is $101,500 and your trailing drawdown which originally was at $96,500 is now at $98,000. You still have $3,500 in space.

For a company who updates after each trade, the numbers will be less favourable. We do the same exercise, just after each trade. You start with $100,000. Your first trade you make $2,500. Your trailing drawdown of $3,500 which means you couldn’t fall below $96,500 originally, has been pulled up by $2,500, so it now sits at $99,000. This is the lowest number you could pass before breaking a rule. Your second trade you lose $1,000. Your balance is now $101,500, same as before. Your trailing draw down never goes down though remember, only up. Therefore your trailing draw down hasn’t moved after trade number 2, and still sits at $99,000, or you now have $2,500 in space.

Trailing Draw Down – When It Does Stop

Hopefully you are still with me. Now to something good about trailing draw downs. Most companies, not all, but most, will stop trailing once your trailing draw down reaches the initial balance.

Let’s continue with the same example #2 above. Your Day 1 ending balance was $101,500 and your trailing draw down was sitting at $99,000. Let’s say on Day 2 you really have a great day and make $2,500 in profit in 1 trade. Your ending balance is now $104,000. Since the trailing draw down stops at the initial balance, once it hits $100,000, that’s it. It’ll never go above that, and it’ll also never fall down. From this point forward you only have your daily loss limit to deal with.

Another way of thinking about it if it all seems confusing – if your trailing draw down is $3,500, once you reach that much in profit, you know you can never fall below your starting balance again.

An Example Of Daily Loss Limit and Trailing Draw Down Combined

This might all seem kind of confusing, but once you get into the evaluations you’ll see quickly how they work.

Day 1 – Using the same example above of a $100,000 account, $2,200 daily loss limit and $3,500 trailing draw down. Remember, whichever of the 2 is smaller is your main concern at any point. So Day 1, trade 1, you can’t lose more than $2,200. We said you finish Day 1 with a $101,500 balance.

Day 2 – Your trailing draw down is at $99,000 in the case of a company who calculates it after every trade. Your starting balance for the day is $101,500. The most you could lose and hit your trailing drawdown is currently $2,500. BUT remember, your max daily loss is $2,200. Right now, that is your number and you can’t lose more than that. Luckily Day 2 goes well, you make $2,500 and your balance is $104,000.

Day 3 – We said we ended Day 2 with a big winner and a balance of $104,000. Your trailing draw down stopped at $100,000. As of right now your main concern is still the $2,200 daily loss limit. Well, Day 3 doesn’t go so great, and you lose $2,100. You haven’t violated a rule, you stop trading and live to trade Day 4. Your balance is now $101,900.

Day 4 – First as always lets make sure we know where we stand. Our balance is $101,900. The most we can lose according to our daily loss limit is $2,200. BUT remember, our trailing drawdown was pulled up to the $100,000 mark. That means losing more than $1,900 will bring us below that and violate a rule. Now the trailing draw down amount is our concern.

Tips Regarding Daily Loss Limit and Trailing Draw Down

First, know exactly where you are at to start the day, and also during the day. The daily loss limit is pretty straight forward. If your’s is $2,200, know that. The trailing draw down also know where you are.

Second, know which of the 2 is smaller. If your Daily Loss Limit is $2,200 but because you had some winning days and pulled your Trailing Draw Down upwards, followed by a losing day, you may only have $1,000 of buffer.

Third, whichever is smaller, don’t allow yourself to get even close to it. If you have $1,000 of space between your account balance and your trailing draw down, set your maximum draw down as $500 for the day. Don’t get dangerously close. Believe me, I’ve done it far too many times. If you have $1,000 of draw down available and take a $900 loser, you now only have $100 of buffer for your next trade and it gets real tough.

Fourth, tip toe away is how I phrase it. When you are anywhere near your draw down or daily stop loss, size down, trade small and trade conservatively. Get yourself to a place where you have a nice buffer again.

Fifth, monitor your trailing draw down. Your daily max loss won’t change, if it’s $2,200 its always $2,200. Your trailing draw down though will trail. Monitor where this number is at after every trade.

Conclusion

Draw downs and maximum losses are going to be the 2 rules that most people break. It’s easy to go on tilt, have a series of bad trades and break these rules. Knowing what they are and where your balance is in relation to them is key to surviving.

Be Notified Of New Trader Evaluation Promotions

Submit your email if you want to be notified of new trader evaluation promotions. I never spam nor sell anything. Usually 2-3 emails a month are sent with the latest deals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.