October 2024 Update: I’ve decided to no longer work with several firms as there are industry regulations coming and I don’t believe several firms will meet the criteria, including this one. I am leaving this article up but all links to to companies I no longer represent will forward back to my main Deals and Promos Page.

You can find more information here: Regulations Are Coming – October 2024 and also find my list of recommended companies that will be compliant.

Earn2Trade starting in July 2021 made a great change to their draw down rule for traders. The short version – your trailing draw down is now updated at the end of the day, NOT during each trade. Read on traders.

As well they are running a great sale in July 2021 with 40% off ALL evaluations. Normally just 1 account size is on sale each month, so this gives you the flexibility to get any of them. I’m currently in the $150K as I write this (mid July 2021).

Trailing Draw Downs Explained First

Let’s understand trailing draw downs first before getting to the sub-level of why an End of Day is better than an Intra Day.

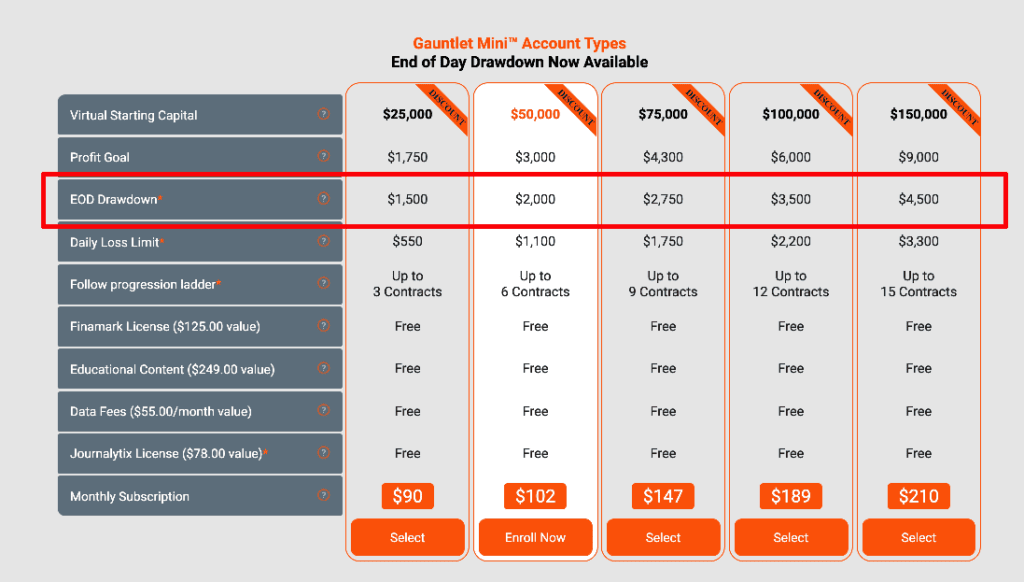

A trailing draw down is an amount that you can not lose, and if you do so you would be breaking a rule. So for example, in the $150K Gauntlet Mini the Draw Down is $4,500. You can always find this information on their main page for the various account sizes.

Side note, the prices shown below are the 40% off July 2021 sale.

So Day 1 $150,000 account starting balance, you could lose up to $4,500 before you’ve broken a rule (there’s a bit more to this actually when you factor in daily loss limits also, but lets just focus on Trailing Draw Down).

When you make profits, lets say you do a trade and get to $151,000, a “Trailing Draw Down” gets pulled up by $1,000 also. So now your minimum balance went from $145,500 to $146,500.

Trailing draw downs never go down, only get pulled up. As you reach new profit highs, the drawdown is pulled up.

Continuing the example, lets say your next trade is a $2,000 winner. Your draw down is now pulled up $2,000 more, and your balance is now $153,000. Your draw down balance is $148,500.

But alas your next trade is a loser, $2,000. Your balance is $151,000. Your draw down doesn’t move, and your minimum balance before breaking a rule is still $148,500. Remember, draw downs never get lower, only get pulled up.

So to reflect at this point your balance is $151,000, your minimum balance is $148,500, or a buffer of 2,500. Makes sense right? You have an initial $4,500 draw down, you pulled it up some with the winners, but the $2,000 loss made you back track towards it, and now you only have $2,500 in buffer.

One last point – draw downs stop at your initial balance. So once you surpass $154,500 in profit, your draw down will be pulled up to $150,000 but never go higher. So when you are at $156,000 for example, your draw down remains at $150,000.

Intraday Drawdowns (The Old Way)

So in the past your drawdown would be updated during each trade. The example above is very much the same, and all the above could happen in the course of 1 day previously. You could have a big winner, pull your draw down upwards, then have a big loser and back track all in the course of a day.

Where this would hurt people is those who trade very volatile markets. The drawdown is pulled up by open P&L. Say you went long, a trade shoots up to where you’d be $3,000 in profit, but immediately turns around and comes down, and you exit taking only $1,500 in profit. Well unfortunately, the $3,000 it reached is what will be reflected in your draw down. Again, this is the old methodology just so you have a basis to compare.

End of Day Drawdown – The New Better Way

As mentioned in July 2021 Earn2Trade changed how they calculate the draw down and it is far, far better for traders.

Instead of your drawdown balance being calculated during each trade, it now isn’t touched until after the day has ended. You can have as many ups and downs as you like all day, what matters is your ending balance.

So for example, you start with $150,000. Trade 1 is a $3,000 winner. Trade 2 is a $2,000 loser. You end the day at $151,000.

Previously, your draw down would have been pulled up intraday, so from $145,500 to $148,500.

Now, your draw down wasn’t impacted by that big winner to start. Your ending balance is $151,000, your drawdown is based on that and is now $146,500.

Effectively, that $2,000 swing in the example didn’t hurt your draw down now. Great right!

One last thing – the new End of Day Drawdown rule applies to the Evaluations, and to the LiveSim accounts. Funded accounts do still have a normal intra-trade trailing draw down, at least as of July 2021. Always be sure to read the rules on their site as things change over time and I might not always update the info timely.

Conclusion

The rule change has been really well received from what I’ve seen people saying, and myself 100% agree. I’ve been victim myself to the “have a big winner followed by a big loser” and it hurts your draw down, but no more. You have a fixed balance you know you can’t fall below for the day and that is that.

Video About It

Earn2Trade Discord: https://discord.gg/earn2trade

Unrelated to the above but I wanted to share here as well –

Earn2Trade started a Discord server and it’s great. I had been considering opening my own Discord server, but honestly didn’t want the obligation of maintaining it, participating regularly, moderating it and all the other work that goes into running a Discord server.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.