Spoofing – Time Of Day/When To Trade – Margins

Overview – Page 1 – Page 2 – Page 3 – Page 4 – Page 5 – Page 6 – Page 7 – Page 8

Spoofing and Fake Order Spotting

Spoofing is more of an issue in the thinner order book products, which in treasuries is the Ultra Bond. There’s not much spoofing in the 10 years. When the book is thousands of contracts at each price level, it’s a lot harder to put on a fake order of 10,000 contracts.

I don’t have much to say about spoofing. It exists, you get to the point of being able to spot it. There’s nothing you can do about it, so just know how to read it and don’t rely on those orders holding up. It happens all day long, it isn’t infrequent. When the bids or asks about 3 ticks away from the current price action is an abnormally large amount, most of it is spoofed. For example, when there are no more than 20 contracts sitting on the bid or ask at most prices, but there are 300 sitting at the ask a few prices away, most of that will evaporate when the activity approaches that price level.

The main thing to keep in mind is those big numbers aren’t real. There isn’t an order wall there, it’s going to disappear. Don’t read into them anything. Read the price action at the current prices.

Below is a video with a very obvious example of spoofing. You’ll see the orders quickly get put on and pulled off over and over.

Time Of Day and Order Flow

What time of day do I trade? The short version of this is I personally trade 8am until 12pm each day. Sometimes not even on Fridays. That’s about it.

The longer version is why I only trade that 4 hour time frame: When I first started trading, I loved that it was basically around the clock. I was there for the Globex open, traded late into the evening, and back at it in the morning. What I eventually realized was most of the money was being made in the morning. Sure you can trade in the evening, but the volume just isn’t anything like it is in the morning. The pit session if you will. The treasury pit hours open at 8:20am EST. That’s why I start at 8am approximately. It’s when things start heating up.

As well at lunch things come to a crawl. That’s when I call it quits. Sure you can trade the afternoon, again do what ever you want. This is just what I do. Grinding it out, sitting glued to a screen all hours of the day doesn’t appeal to me at all anymore. There’s plenty of opportunity other times of the day sure, but the best opportunity is 8am to 12pm. Again, this is what I do, you do whatever you like. Life is a lot better though not sitting around trading all day and night.

Front Month

A quick word on the front month. Since futures contracts are for a specific date, we as traders would typically trade the “front month”. The front month is the contract typically which is closest, and has the most volume. The front month can vary by product since some products like Crude Oil for example is a monthly contract, or the treasuries (and equity indices) are quarterly.

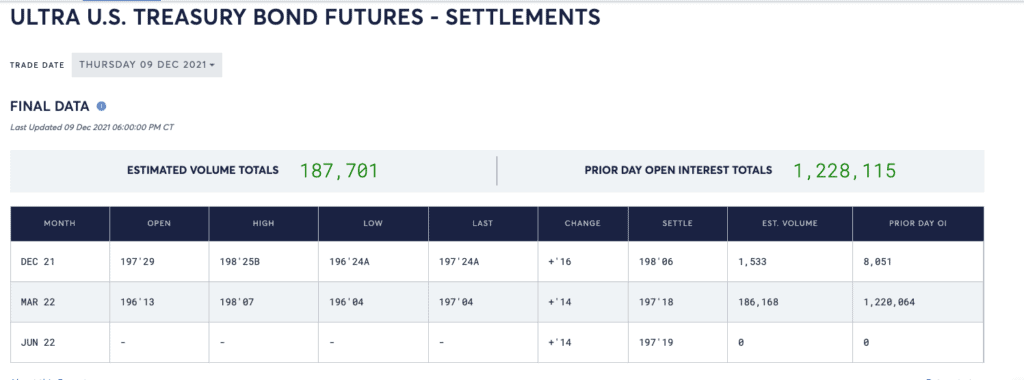

How you check on what the front month is easily is go to the CME Group website, and look up your product, and click on Settlements. Which ever contract has the bulk of the volume is your front month you should trade. Now, sometimes the current periods contract isn’t closed yet, but everyone has moved onto the next. Here’s a great example:

This is the Ultra Bond UB as of December 10th, 2021. Notice that the December contract still has some activity (look at the 2nd last column, Est. Volume), but the bulk of the volume by far is March 2022. Everyone is now trading the March contract, or in cool talk UBH2.

You can do this for any product, and is the best way to know. Another way to know is one day you go to trade your favorite product and there is next to no activity. That should be your indication that probably the month/quarter has rolled over.

Margins

I’m including a section on Margins just so people understand what they are. I know a lot of my audience is involved with trader evaluation prop firms, where you really don’t have to worry about margins. You are given a set number of contracts to trade with. Someday though the goal for all should be to open your own account and trade your own money.

When you trade your own capital you are the one putting up the money. How many contracts you can trade depends on how much money you have in your account.

Margins are an amount that will be set aside in your account on a per-contract traded basis. It is while you are in an open trade. So if you have a $10,000 account and decide to trade 5 Ultrabond contracts and the margin is $1,000 per contract, then $5,000 of your capital is tied up.

To take this to an extreme example, the more contracts you trade, the more that is tied up and also the sooner you’ll get quickly stopped out. Say you have $10,000 in capital and decide to trade 9 UB contracts, tying up $9,000 in capital. You have $1,000 left that you can lose before your broker isn’t happy. Trading 9 UB contracts, basically once you lose 4 ticks, you have violated the margin rules (9 lots x $31.25 x 4 = $1,125). They will liquidate your position and also most likely charge you a margin violation fee. Don’t do that.

If you want to see what the current margins are, visit your brokerage.

I will mention margins for Intraday (ie. you close your position before the market closes) are what I normally refer to. If you hold positions over night, the margins go up significantly. More risk for the broker means more you need to stake.

Margins are set by your broker, and will vary. Most brokerages do compete on margins and try to offer the lowest available. Others though don’t and you will drastically different numbers. For example one brokerage I know of has a $12,000 margin for Ultra Bond. Big difference – put up $1,000 or put up $12,000, to trade the same 1 lot.

Continue To Page 6 –>

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.