Understanding margin in futures trading can be new to traders. Most people new to trading futures have a hard time understanding why you are allowed to trade a product without having to pay the full amount for it. Not only that, the amount you are technically borrowing is quite large.

Margin – The Down Payment of Futures Trading

Just to clarify, it’s not a down payment in the sense that you own outright now the thing you bought, let’s say 1 contract of ES. You are putting up capital with your broker, out of your account, that will be set aside while you trade that contract. If you have a $5,000 balance in your account, and intraday margins are $1,000, if you bought 2 contracts, that is $2,000 that is set aside for margin. That also leaves you $3,000 in capital.

Where this gets very important is when you try to max out your margin. If you have $5,300 in your account and margins are $1,000, and you enter a 5 lot trade, well now $5,000 is tied up in margin, and you only have $300 left that you could possibly lose before you start violating margin rules.

The last thing to keep in mind when figuring out how much you want to tie up in margin vs. leave for possible loss, the bigger the size you have in contracts, the more quickly you can lose money, and you also have less to lose. Trade 1 lot with a $5,300 account, well you have $4,300 left to lose before things get really bad. Trade the 5 lots from above, you only have $300 to lose, and you will lose 5X the amount per tick.

Day, Night, Initial Margins – What’s The Difference

Basically it comes down to time frame and risk. Holding a position during the US trading hours there’s less risk to your brokerage. Go overnight, more risk. Hold past the close? Most risk.

Some brokerages have the same margin for day and night, and only differentiate when you hold past the close. I have an example below, Tradovate does use a higher margin for the evening/night session.

Example From Tradovate

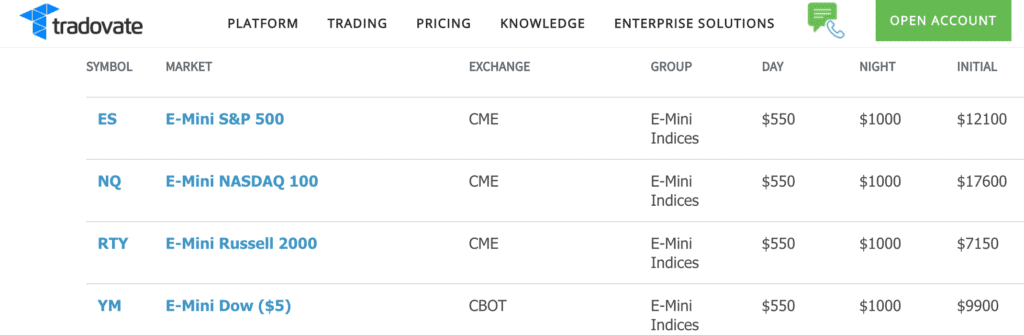

Below is from the Tradovate site, one of the brokerages I use myself. Here you can see the big difference in margin requirements based on time frame.

As you can see, the requirements to trade during the day (normal US hours) are the lowest, $550 for ES for example. If you wanted to open that position in the evening Globex session, you’d have to put up $1,000 per contract. The big jump is if you hold past the close and into the next day. Make sure you close those positions or face getting a margin call, getting liquidated and probably fees as well.

Note that the numbers below aren’t out of the ordinary. Any brokerage will have a substantially larger requirement to hold into the next day.

The Scale Of Margins

People don’t often think about what they are really doing when they buy a 1 lot of ES and let’s say the day margin is $550 like from above. You are putting up a very small fractional percentage of the actual value of that contract. You are very highly leveraged.

Conclusion

It’s important to understand the concept of margin, but even more so I think it’s important to understand how to manage your margins and leverage relative to your account size. Things can get out of control quick when you get into too large of a position, are highly leveraged, and don’t leave yourself much left in available capital to handle any losses on a trade.

Be Notified Of New Trader Evaluation Promotions

Submit your email if you want to be notified of new trader evaluation promotions. I never spam nor sell anything. Usually 2-3 emails a month are sent with the latest deals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.