Officially called the Ultra U.S. Treasury Bond Future, if you’ve watched any of my content on YouTube more than likely I’ve mentioned and/or traded the Ultra Bond. The Ultra Bond goes by the symbol UB for reference. More about my favourite product to trade down below. I’ve listed out what I think are the most important and basic aspects to know, but there is certainly more to it.

First: The CME Official Information

If you want to get to the official source of all things Ultra Bond, visit the CME Groups website. They will list every single contract spec you could want, the volume traded, front month and more.

CME Group Ultrabond Contract Specs: https://www.cmegroup.com/trading/interest-rates/us-treasury/ultra-t-bond_contract_specifications.html

Contract Unit

1 Ultra Bond futures contract represents 1 ultra bond with a face value at maturity of $100,000

Price Quotation

The price of the ultra bond is quoted in points ($1 increments), followed by a 1/32 fractional amount, with a basis of 100 points. Sound confusing? See the example below.

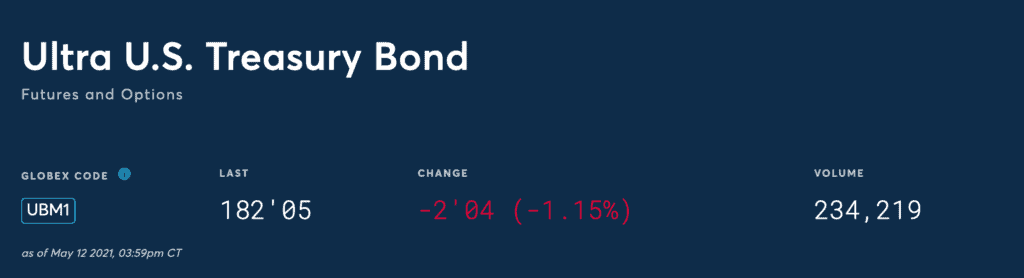

For example, below is a quote from today. The last price was 182’05, meaning there is 5/32’s for the last 3 digits, which equals $156.25 ($1,000/32 X 5). The fully written price would be $182,156.25. You will never see this price though while trading, you’ll see 182’05.

Tick Increment

Since the price trades in 1/32’s, each tick movement is 1/32 of $1,000 or $31.25. So if you were long 1 contract at the price of 182’05 and sold for 182’06, you would make 1 tick, or $31.25.

Worth mentioning the 30 Year U.S. Treasury Bond (ZB) also trades in this same manner, 32nd’s. When you get to the 10 Year and 5 Year, they trade in 1/64’s, or $15.63 per tick.

Contract Months

Ultra Bond is a quarterly contract, with listed contracts ending in March, June, September and December. Trading terminates at 12:01 p.m.on the 7th business day prior to the last business day of the contract month.

So What IS The Ultra Bond?

You’re thinking great Canadian Futures Trader, thanks for giving me a bunch of info I could see on the CME website. Still, what is the Ultra Bond?

From the CME Group themselves:

U.S. Treasury bonds with remaining term to maturity of not less than 25 years from the first day of the futures contract delivery month. The invoice price equals the futures settlement price times a conversion factor, plus accrued interest. The conversion factor is the price of the delivered bond ($1 par value) to yield 6 percent.

How I Describe It:

“The Ultra Bond Treasury Contract (UB) are for 30 year US Treasury Bonds with expirations of 25 years or greater. This compares to the 30 Year Treasury Bond Futures Contract (ZB) which are for the same 30 Year Treasury Bonds, but with expirations in the 15 to 25 year range. Same product ultimately, different time horizon.”

Usually people are still completely confused, but I’m not sure how to make it much more simple. Most people can’t wrap their heads around how they are both the 30 Year US Treasury Bond, but somehow different. Remember, you are trading a CONTRACT to purchase the 30 Year Bond, you aren’t trading the actual bond itself. Those basket of goods that contract represents are the same underlying product, but some are older than others.

To take it 1 step further, there’s a reason the Ultra Bond has more movement than the 30 Year (ZB). It’s a contract that represents a product that’s further out in time, and thus there’s more time sensitivity.

Conclusion

Hopefully that helps you aspiring Ultra Bond traders. I think it’s important to understand what you are actually trading, not just the product codes and tick sizes.

Be Notified Of New Trader Evaluation Promotions

Submit your email if you want to be notified of new trader evaluation promotions. I never spam nor sell anything. Usually 2-3 emails a month are sent with the latest deals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.