When you trade your own futures accounts there’s no getting away from commissions and fees. Below is a break down of the various commissions and fees in futures trading, as well as some ways to minimize them.

Real Example For Reference

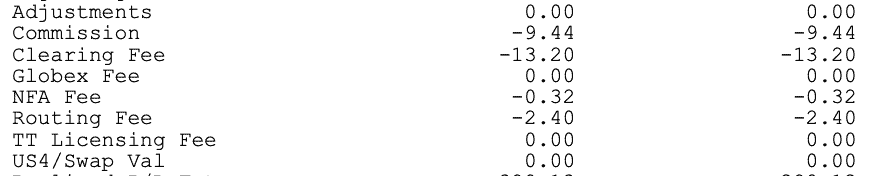

Below is an example from a 1-day statement of mine on what you may see. I trade futures, mainly treasuries and NQ.

Commission

This one is pretty straight forward. It is the commissions your broker charges and how they make their money from you. When you see a commission rate published on a brokers site, this is what they are advertising.

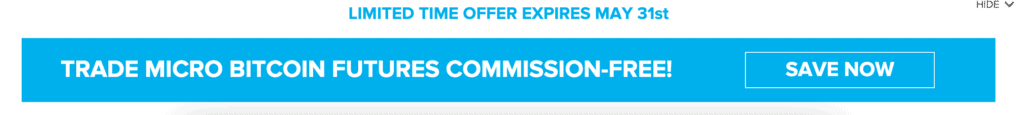

Often times as incentive they may offer “First $200 in commissions on us!” type of offers. This is what would be discounted. You will still pay the other fees as they are essentially pass through. Example below:

Commission Levels

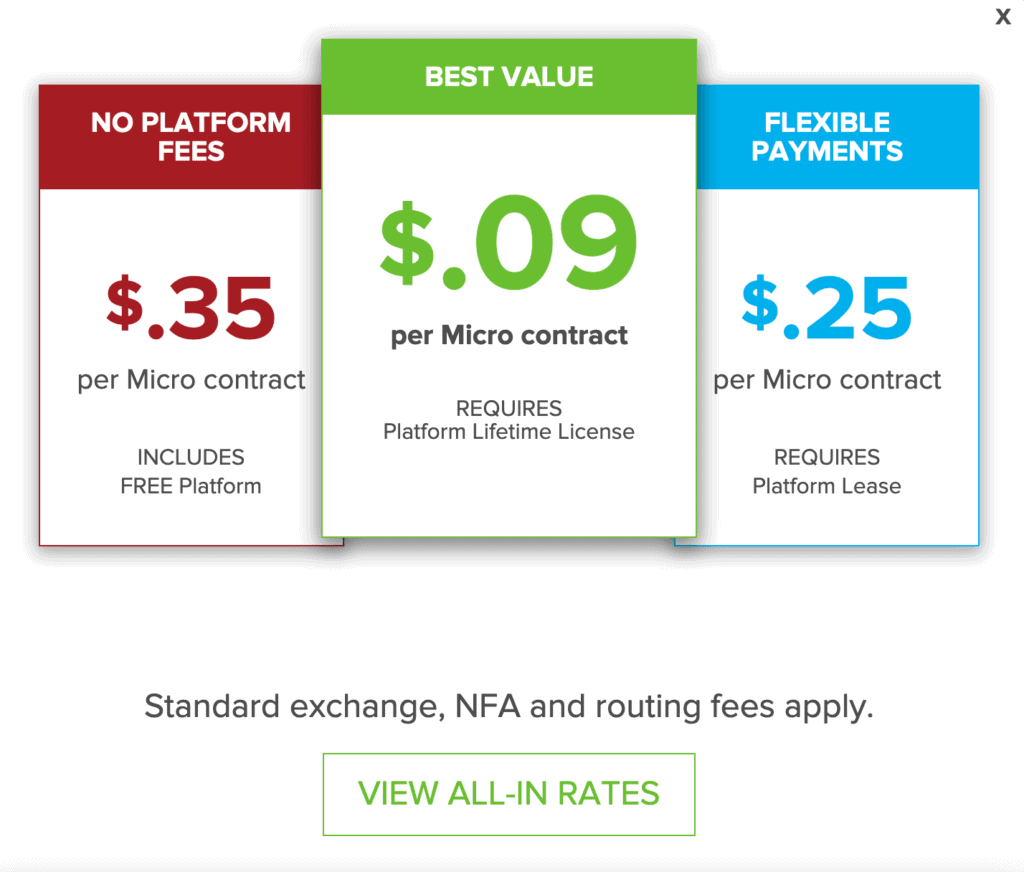

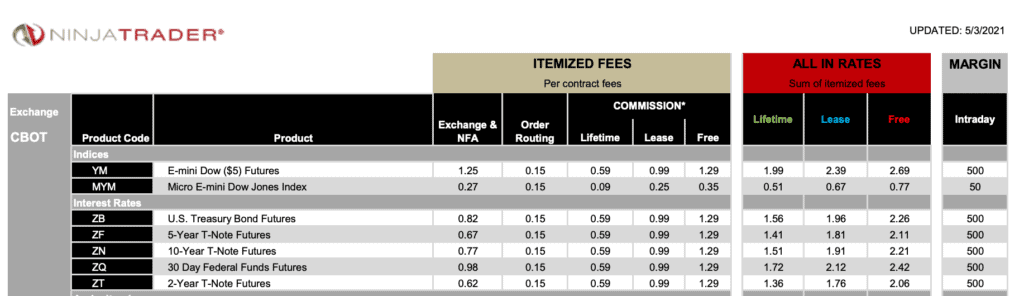

Brokerages usually allow you to pick your commission level. You can get cheaper commissions by either paying a set monthly fee or in NinjaTrade Brokerage case, if you either lease or buy the platform you get cheaper commissions.

You can see in the example below there are substantial savings by buying the software. The difference between $0.35 and $0.09 may not sound like much, but remember thats on both sides of a transaction (buy and sell), multiplied by however many contracts you trade.

Clearing Fee

Clearing Fees are assessed by the CME Group, again passed onto you by the brokerage. As you can see in the above statement my clearing fees were higher than commissions. Note again these are per contract, so there’s no hard stop and no way to get rid of these.

You can learn more about the CME Clearing Fees here: https://www.cmegroup.com/company/clearing-fees.html

NFA Fee

NFA is National Futures Association. The fee is payable by all futures trader, again per contract on both sides. Without getting into the specifics of who the NFA is, it’s another pass through fee your broker must charge you. Luckily it’s relatively small.

You can read more about the NFA and their fees here: https://www.nfa.futures.org/faqs/members/nfa-assessment-fees.html

Routing Fee

Order routing fees are per contract and vary depending on your connection. For example with NinjaTrade Brokerage using the CQG feed it is $0.15 per contract. In the example above my fees were $2.40 meaning there were 8 contracts traded in aggregate (you pay on both sides of the trade).

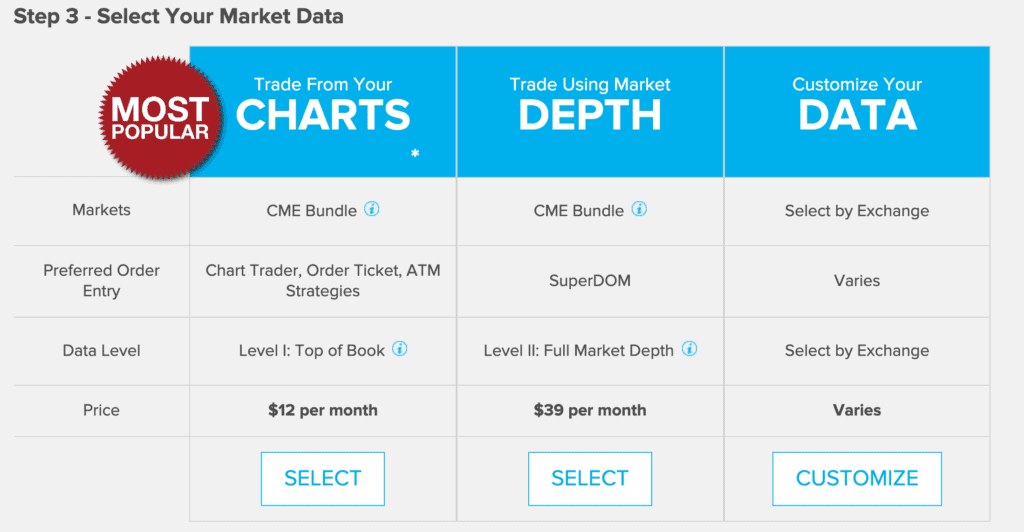

Data Fees

Not listed above is a monthly data fee you will have to pay. The amount varies depending on your broker and also what level of data you require, and which exchanges. It’s a once per month fee usually. As an example I pay $39 for full access to data for the usual markets such as CBOT, CME, NYMEX, etc.

Example below from NT Brokerage. The middle plan is what I use, $39 CME Bundle. All the markets I would trade, full Level II Depth. You can also choose Customize Your Data and select individual markets. It’s basically $15 per market for Level II, so if you only trade 1 or 2 markets this would be cheaper. Even though I usually only trade 2 markets, I go for the full depth just incase I decide to explore. For example, UB and ZB are CBOT, NQ is CME, and CL is NYMEX.

All In Rates

To make life easier, usually brokerages will show you the “all in rate”. Since the only fees above that change based on your choice of commission plan is commissions, they are able to show exactly what the fees will be. For example, I know that All In rate on Ultra Bond is $1.61 per side, or $3.22 in total for a trade – a buy and a sell.

Example below of NinjaTrade Brokerage and how they show their fees. You can see the itemized rates, as well as the All In Rates. For example, I often will trade ZB which has an All In Rate under Lifetime of $1.56. For every 1 contract I trade I will spend $3.12 in total in all fees, per trade, per contract.

Conclusion and Tips

Pretty much the only fee you can control directly is the Commission Rate. Each trader should estimate how many trades they will make per month, and decide if it is worth paying a higher up front fee for lower commissions. Myself, I make several trades per day so with NinjaTrade Brokerage even though I seldom use NinjaTrader software, it made sense to buy the lifetime license, get the lowest commission rates. It’s a one time (or spread over 4 months if you like for slightly more) investment, but will once and done. With a lot of other platforms, you pay an up front monthly/quarterly/annual fee for lower rates, but that will always continue. At the end of the day, do the math and decide what is best for you.

Also be sure to carefully consider your commissions and your trading style. If you do a lot of trades those commissions add up quick. I’ve seen traders give away all profits just in commissions. Trading micros can also be dangerous. The low margin and low commissions seem attractive, but at the end of the day the profit per tick is also fairly small and can eat your bottom line up quick.

Be Notified Of New Trader Evaluation Promotions

Submit your email if you want to be notified of new trader evaluation promotions. I never spam nor sell anything. Usually 2-3 emails a month are sent with the latest deals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.