I basically taught myself order flow scalping with the hope of free videos on YouTube. Below are some of the resources I believe are the better ones. Nothing is perfect, and a lot comes from taking the information and testing things out, and ultimately refining it to be your own style. These resources though are a good starting point.

My Beginnings – From Technical Analysis To Order Flow Scalping

When I first started trading, I went down the usual roads of learning technical analysis. MACD, RSI, EMA, SMA, Bollinger Bands, the list goes on. Everything looked great in the videos, so simple. In practice though nothing worked as good as people made it seem. Sure, it could be in a big part my amateur abilities, but even still, it all seemed a little arbitrary. Looking then at technical analysis with more of a critical eye, I started to really doubt how reliable it is.

I have to admit, when I see charts now with about 10+ indicators on them, I have to admit I laugh. If it works for you great. But usually it seems more like people trying to overwhelm people with information to make themselves look smart. Using information from the past to predict the future just wasn’t sticking with me.

Technical Analysis On Overload

Enter order flow. I don’t remember specifically how I came across it or whose video I saw first, but somewhere in my YouTube travels I stumbled on the concept of using the actual, in the moment, buying and selling happening to see what people were doing. Not only what was being bought and sold, but what orders were on the books, limit orders, at the various prices above and below the current price. Actual supply and demand visualized not with lines and dots, just pure numbers.

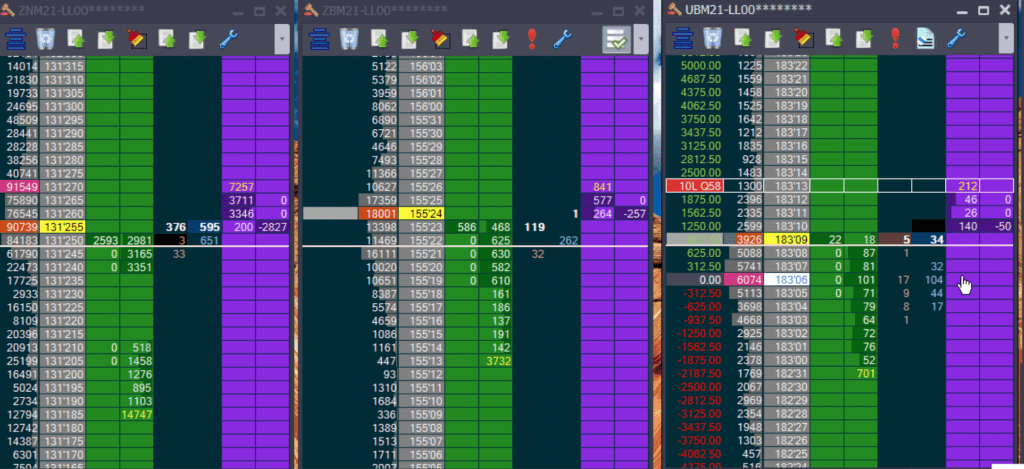

Sample Jigsaw Daytradr Depth of Market

But that’s enough about my background and distaste for technical analysis. Suffice to say, order flow just made far more sense to me from day one. Sure there’s some learning to do about what all the columns of numbers mean, how they move, how to interpret them. That’s where the below helped me learn.

Learning Order Flow

There are a few YouTube channels I recommend to learn order flow. I will mention I never paid for a course, a webinar, a chat group, nothing. Everything was learned for free, on YouTube. I did pay for Jigsaw Daytradr software when I realized I really wanted to embrace order flow scalping, and in that I had access to over 10 hours of additional trading on the Jigsaw website, but that was a bonus, the software is of course what I wanted.

Peter Davies – Jigsaw Trading

Youtube: https://www.youtube.com/c/JigsawtradingPlus/videos

Peter is the founder of Jigsaw Trading, who makes Jigsaw Daytradr, the software I personally use. It is one of the few Depth of Market (DOM) specific software packages. While most trading software will offer some type of DOM, they don’t allow you to see the all of the information as Jigsaw. Actual orders being added and removed, executions, strength meters and more. It’s highly customizable, below is an image of one of my Jigsaw set ups for trading treasuries.

Jigsaw’s YouTube channel has a combination of both “how to use Jigsaw” type of videos, and also actual scalping techniques. If you like Peters teaching style, like I mentioned above if you buy Jigsaw you get access to about 10 hours of additional order flow scalping techniques taught by Peter. He’s a great guy, and active as well in the various trading forums.

John Grady – No BS Day Trading

Youtube: https://www.youtube.com/user/NoBSDayTrading/videos

John’s material is what I primarily learned scalping using Jigsaw from. His content is somewhat dated, many years old now. That said, the concepts still apply the same today. John is also why I switched to trading treasuries from crude oil. As much as I wanted the action, I saw the reasoning behind scalping treasuries. Slower moving product, more obvious order flow action. John does sell courses on his site, I haven’t taken them myself.

Axia Futures

Youtube: https://www.youtube.com/c/AxiaFutures/videos

Axia is a prop shop out of London, and puts out a lot of content, so you would have to look for the order flow specific content. It is good, they are a bit more on the selling themselves side, just as a warning. Still, I think there’s value in the order flow content.

Fat Cats of Wall Street

Youtube: https://www.youtube.com/c/FatCatsOfWallStreet/videos

I recently found Fat Cats channel. He’s a scalper, a bit of a character, but I like his content. It’s no nonsense, lots of swearing, but you get the feel he’s a real guy just scalping and talking you through his logic. He’s not selling anything, and I like his reasoning process in trading.

Futures.io

Youtube: https://www.youtube.com/c/futuresio/videos

Futures.io is a popular trader forum and I do highly recommend it. Besides being a forum, they host webinars often. They have quite a bit of content on their YouTube channel, but there is scalping information on there. As well you will find the people mentioned above who have hosted webinars with Futures.io, so for example Peter Davies or John Grady will have additional content on Futures.io channel.

Conclusion

If you are interested in learning order flow scalping, the above will keep you busy for hours, days weeks. Use the resources as a starting point. You won’t be an order flow expert after any video. Take the knowledge, try things out, adapt to your own style. Test things out. I recommend not paying for courses, and never pay for gurus or experts. I learned on my own, for free, and you can too.

Be Notified Of New Trader Evaluation Promotions

Submit your email if you want to be notified of new trader evaluation promotions. I never spam nor sell anything. Usually 2-3 emails a month are sent with the latest deals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.