Summary Review of Apteros Trading

Even though Apteros Trading improved their trader evaluations after launching, I still don’t feel they great for most. I recommend several other companies and you can find all my Funded Futures Trading Reviews here. Read below and decide if Apteros is a good fit for you. I believe there are easier, more affordable options for newer traders. You can find those on my Exclusive Promos page.

Note that this review is based on information from 2021. I won’t be continuing to update as Apteros makes program changes. If I hear of any major updates, certainly I will update. As of 2024, I’m still not a fan. You can also read my very first review of Apteros here.

My Top Rated Funded Futures Programs

- Apex Trader Funding Review and Discount

- Topstep Review and Discount

- Take Profit Trader Review and Discount

Introduction To Apteros Trading

Apteros Trading is a futures proprietary trading firm, started by Merritt Black, previously Head of Futures and Commodities at SMB Capital. If you aren’t familiar with SMB Capital, they are one of the most prestigious proprietary trading firms out there and have been around for decades.

Apteros Trading has positioned themselves as one of the higher-end prop firms in the market space right now. They differ somewhat from the prop firms I have mainly covered on my site and videos, but not entirely different.

Essentially, they offer a more premium product that includes coaching and mentoring, risk assessment, and education along with a trader Tryout. As well, their rules mirror much more a traditional Prop firm account in terms of risk you can take based on margin, their commissions, and more. In the following, I’ll go over the rules and how they work, the pros and cons of Apteros Trading as a stand-alone company, and also how they compare to other trader evaluation companies I’ve been through myself.

You need tocheck out my Reviews of Funded Futures Trader Evaluations. I update it every day.

In April 2021, I put out a scathing review of Apteros Trading that was not flattering at all. The reason I’ve decided to write a new review is the company has done a complete overhaul of their trader evaluation program, and the feedback I had 3 months ago is not reflective of the current Apteros Trading. I give them quite a bit of respect for taking the feedback of the market and adjusting their program to be competitive, while not giving up the core principles they stand by. So just in case, you were wondering why I had a change in opinion, it has everything to do with the great changes they have made.

Evaluation Summary

Below is a summary of the evaluation. There is only ONE account size to try out on, a $50,000. Afterward, I’ll explain in more detail some of the specifications.

- 1 account size

- $50,000 buying power

- $10,000 net profit goal

- $4,000 max draw down

- $1,500 daily loss limit

- 30 trading day minimum

- $315 per month, minimum 2 months fees will be paid due to 30 day trade minimum

- No trailing draw down

- Number of contracts depends on actual maintenance margins

$50,000 Buying Power

Unlike the trader evaluations programs you probably are familiar with where your account is given a nominal amount such as a $50K evaluation, but your true buying power is dictated by how many contracts you are limited to, Apteros Trading handles it differently, but much more how the real world works.

The $50,000 buying power is actually 100% of the $50,000 buying power. There is no set number of minimum or maximum contracts you are allocated. The actual CME Group determines your position size based on their margins. It’s exactly how the real world works. If you have $50,000 in an account, your buying power is determined this way.

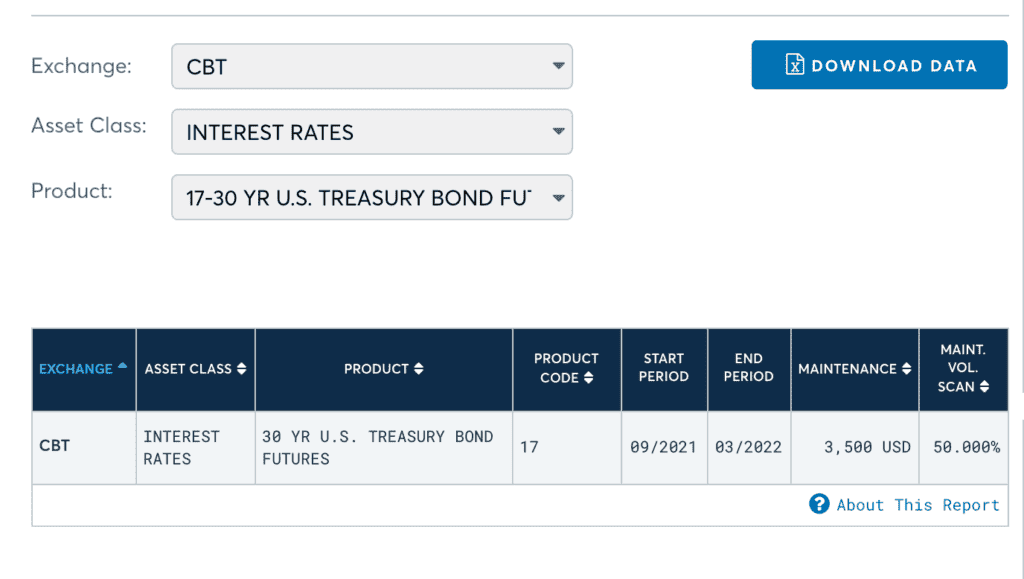

ZB – 30 Year Treasury Example

Let’s look at a few examples. I like trading the 30 Year Treasury Bond, ZB. Looking at the CME Group website, the maintenance margins are $3,500 for this product. In theory, I could trade 14 lots (not recommended FYI). Even if I were to trade a 10 lot, this is far more than you get in a traditional $50K account elsewhere which is usually limited to 5 or 6 contracts max.

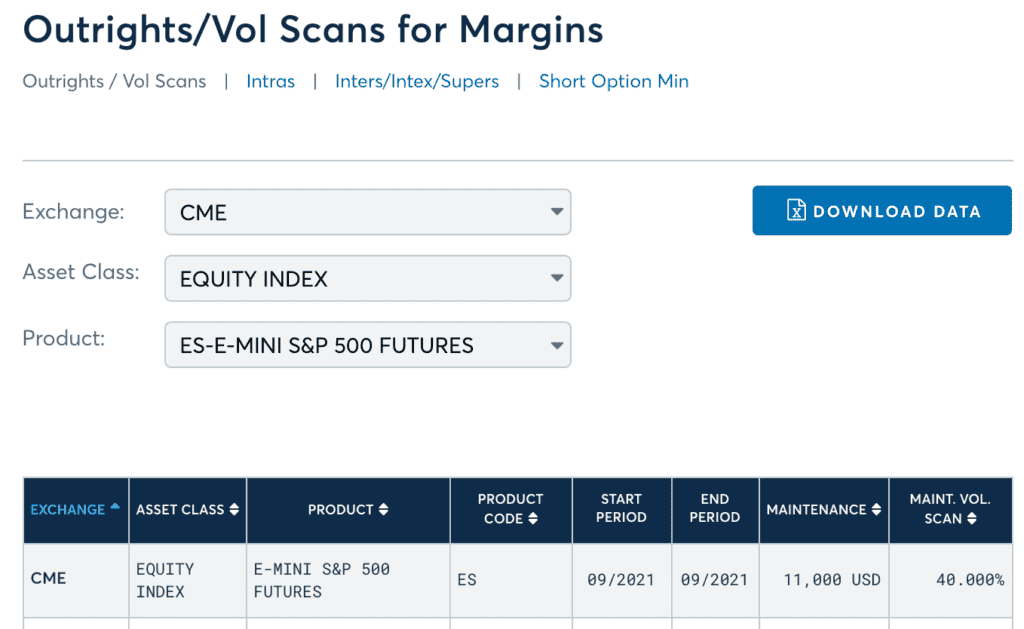

ES – Emini S&P Example

I know a lot of people love trading the ES. Looking at this product, it has an $11,000 maintenance margin requirement. Looks like you are limited to 4 contracts max ($11,000 X 4 = $44,000).

This makes sense though, trade a more volatile product, not as much risk is going to be allocated to you.

$10,000 Goal

Fairly straight forward on this one, your goal is to make $10,000 in profit net of commissions. One step, and again no scaling as explained above your contract sizing is determined by margins not a fixed lot allocation.

Keep in mind there is a 30 trading day minimum. That’s a minimum of 6 weeks, so if you want to average things out, $334 per day after commissions. I think that is very passable myself.

Max Draw Down, Daily Loss Limit and No Trailing Loss Limit

So first off, there is no trailing loss limit which every other firm I’ve tried out with has. Big benefit there. The Daily Loss Limit is $1,500, meaning on any given day you can not lose more than $1,500 from where you started the day. The Max Draw Down is $4,000 meaning the most ultimately you could go down to is $46,000. Fairly simple and straightforward if you ask me. Keep any individual day under a $1,500 loss, and if you have a string of losing days, watch out for the $4,000 max draw down.

Using an example, if you build up a balance of $54,000, at this point you have an $8,000 buffer between your current balance and your max draw down ($54,000 less $46,000). Your biggest concern should be always your max daily loss limit of $1,500.

30 Day Minimum

The 30 day minimum is 30 traded days, effectively 6 weeks, but of course they don’t have to be consecutive if you need a break in there.

While yes I know this is going to sound like an eternity to a lot of people used to 10 to 15 day evaluations, you have to keep in mind the big picture. Apteros Trading is looking for traders who really do want to prove they have the ability to make it long term. The goal is bigger, the time frame is bigger, they want a bigger sample size of trading and for you to truly demonstrate your skills. They’re looking for traders who want to become career professionals, and will treat you as such.

Anything valuable in life is usually hard, think getting into an Ivy League university, joining the NAVY Seals, becoming a Doctor, etc. If you pass a 10 day trial where you yolo’d a 15 lot and coasted for 9 days, that doesn’t make you a good trader, nor is that a recipe for long term success. Apteros Trading has professional money managers in New York who are currently enrolled in NADRO. They are focused on cultivating an atmosphere and culture around true professionalism. If your goal is to pass quick and coast, honestly Apteros Trading won’t be a good fit. Everything is really centred around performance based trading.

Fees

The fee is $315 per month. Keep in mind you have a minimum of 30 trading days, by default you will be paying for 2 months. Once again I know a lot of people used to shorter and cheaper evaluations will balk at this immediately. I did myself as well the first time I saw it. It circles back again to Apteros Trading being a premium product. You get the coaching, mentoring, and essentially are trying out for a more formal prop desk position.

Resets – you can reset, the fee is $125 and isn’t held against you as far as your performance being evaluated. Like any reset, you will be starting from day 1 and have to meet the 30 days traded goal.

Funded Account Rules

The Funded Rules and Specs I realize some people won’t love at first glance. Some of what you are permitted to trade and your limits depend on how you performed during the evaluation. If you are a top gun trader and show a lot of consistency and profitable results in the evaluation, you’ll get more leniency than someone who has more volatility.

- Daily Loss Limit will be determined based on your evaluation

- $4,000 draw down, same as evaluation

- Approved products determined by your performance in evaluation

- The $50,000 is a starting point. You will be able to grow your account size substantially, based on performance

Commissions and Profit Split

I’ve put these two together on purpose. The profit split is 60/40 at Apteros Trading, which again, I realize most people reading this will immediately discount that as a negative compared to the 80/20 split elsewhere. I understand and had the same reaction initially. But hold on, combined with commissions it actually works out better financially.

Commission rates at Apteros are far less than other trading prop firms, as they recieve the CME member rates. Instead of paying $4.26 for example, Apteros would charge $1.22 (a savings of roughly 70%). Do enough round trips, and that adds up very very quickly.

Apteros has a great example detailed on their site which I don’t want to recreate but I encourage you to visit. The punchline – if you trade with any normal amount of volume, what you save on commissions will add up to thousands per month in saved commissions, so the 60/40 split at a much lower commission rate works out more favorable than a 80/20 with high commissions. Doing a quick calculation on my own trading – 10 trades per day x 5 lots x 20 trading days in a month on the low end = 1,000 round trips. That $3 (roughly) commissions savings per trade adds up to $3,000 in extra income per month real fast.

One other thing to keep in mind is the leverage you are getting. Apteros Trading is giving you a true $50,000 account with CME Group margins. You can get substantially more leverage and trade larger size. As an example I’d prefer a 60% split on a much larger account vs. a 80% split on a smaller one. Factor in the commissions and it just works out to more money for the trader.

Apteros Trading Compared to Others Prop Firms

I’ve tried out for 5 firms myself (Topstep Trader, OneUp Trader, UProfit Trader, LeeLoo Trading and Earn2Trade) and have passed 4 of the 5. The point being I’m very familiar with them all and their rules. While each of these 5 firms vary in their rules both on evaluations and funded accounts, I would say as a whole they are very similar. You trade 10-15 days, you have a max contract amount, a daily loss limit, trailing draw down, profit goal, and some other rules. I’m taking them as one homogenous group when comparing to Apteros Trading. I’ll refer to them as the Other Prop Firms.

Note there’s several things I don’t mention below, for example trading hours or allowable products. Anything that is basically the same between Apteros Trading and Other Prop Firms I’ve left out on purpose. If you don’t see it, most likely it’s basically the same across the board.

Pros of Apteros Trading vs. Other Prop Firms

- Access to mentoring, coaching and assessment. Big differentiation here and worth the higher price alone. For the Tryout, this is largely done via the Futures Friday’s Q&A but the desk traders get full mentoring and coaching.

- Commissions & Profit Split when considered together = more profit to the trader

- Ability to scale up your account size. Everything is performance based. Be a top gun trader and your account will be reviewed and you’ll be given more permissions. This is really important as you ultimately determine where you can go with being a funded proprietary trader.

- You get free access to Tradervue Gold ($50/month value) – trade journalling (side note I actually use Tradervue myself and it’s pretty great)

- Your allowable number of contracts is based on margin like the real world, I really like this

- Free daily key insights and levels – you can sign up on their Apteros Community page (anyone can do this FYI not just their traders)

Cons of Apteros Trading vs. Other Prop Firms

- Quarterly Withdrawals – Other Prop Firms anywhere from weekly to monthly withdrawals

- You don’t know per se when you start what your funded specifications will be, really depends on how you perform.

- This mirrors what a traditional prop firm does. Ultimately the company makes money from great traders and has no incentive to keep you trading small if you can demonstrate your ability to earn profits. If you are someone who wants to know exactly what you are getting though when you pass, this might be a downside. If you thrive on performance goals and reward, this could be a pro.

Differences – Neither Pro nor Con

- 30 trading day evaluation vs 10 to 15 days – longer doesn’t necessarily mean tougher or worse. If anything it smooths out variance.

- More of a formal evaluation process compared to other prop firms where it’s specific black and white rules

- $630 evaluation fee (2 months x $315) to pass – Other Prop Firms in general $150-$350 depending on account size. Costs more, you get more. As I mentioned Apteros is a premium product.

- $500/month fee once funded – other firms vary from no fees to a fee per market so depends who you compare to

- Mandatory meeting 11am EST Monday-Thursday

Conclusion & Recommendation

That was a lot of information about Apteros Trading, and you might be wondering at the end of it all would I recommend them, and/or would I try out myself. The answers are yes I would recommend them if you are looking for the formal prop firm experience and the idea of coaching and mentoring is beneficial in your mind.

Myself, originally I was excited at the idea of trying out. Once I really thought about it though it probably isn’t a good fit currently. Not in a negative way against Apteros, but the reality is I already multiple funded accounts, I also trade my own capital as well and pretty much have my hands full with the entire Canadian Futures Trader site and videos. I wish I had found Apteros about 2 years ago, just starting out I would have went the Apteros road for sure. I’m not ruling it out though, possibly in the future I’d consider circling back depending on where I go with the CFT and my other accounts.

I mentioned it at the start and I’ll mention it again, Apteros is a premium trader evaluation. You get more (coaching, mentoring, oversight), it takes longer, but it is also closer to a traditional proprietary firm than the other prop firms like I’ve been through are. You get an actual $50,000 balance to trade with. You’ll be trading with people who are dedicated to trading because of the bigger financial and time commitment. And you have the ability to grow your account size which means more margin, more contracts and further growth. Overall it’s going to cost more, but you get more as well.

At the end of the day you have to evaluate what is most important to you as a trader and which prop firm aligns best with your goals.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

You can read more here: Risk Disclosure

Affiliate Disclosure:

The external links on my site and in my video descriptions to trader evaluation companies and software companies are primarily affiliate links. I earn a commission from these companies on any sale made from people visiting these links. That said, I only recommend companies and software I personally use and actually do recommend. Believe me, I turn down a lot of companies who approach me. You can read my full Affiliate Disclosure here.

Additional Disclosure:

The content provided is for informational purposes only. I do my best to keep the content current and accurate by updating it frequently. Sometimes the actual data, rules, requirements and other can differ from what’s stated on our website. CanadianFuturesTrader.ca is an independent website. You should always consult the rules, faqs, knowledge base and support of any of the websites and companies we link to or talk about on our site. The information on their site will always be what ultimately dictates the current rules of their program, software or other. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. The contributors and authors are not registered or certified financial advisors. You should consult a financial professional before making any financial decisions.